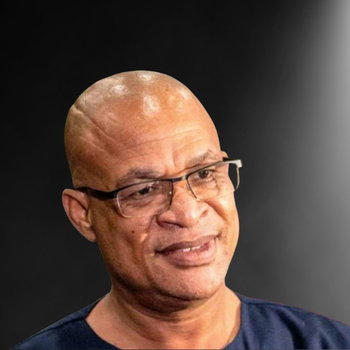

SARB Governor Lesetja Kganyago pours cold water on appeals for more QE

Loading player...

The Governor of the South African Reserve Bank Lesetja Kganyago has commented on pressure from within the country that the Reserve Bank should do more to bring relief during the Covid-19 pandemic. He said emerging markets like South Africa have limited ability for quantitive easing. Speaking to an online event of the South African Chamber of Commerce in the UK, Kganyago said massive QE is possible for countries like the United States, the United Kingdom, Japan or the European Union because interest rates and inflation were low in these richer countries. He said what he had learnt from the pandemic and its effect on economies, was the importance of buffers, and to build redundancy in both the public and private sectors. The Governor also commented on the sectors most hurt by the pandemic and the measures that the central bank took to provide relief to the economy, which he said would only be felt as the economy reopened. Yesterday, Finance Minister Tito Mbowenii also rebuffed suggestions that the central bank could help plug the deficit hole. Mr Mboweni wrote on Twitter that he was against printing money and wants the South African Reserve Bank to remain independent. - Linda van Tilburg Learn more about your ad choices. Visit megaphone.fm/adchoices