SMEs need working capital sooner; leniency from Big Guys – Brendan Mullen

Loading player...

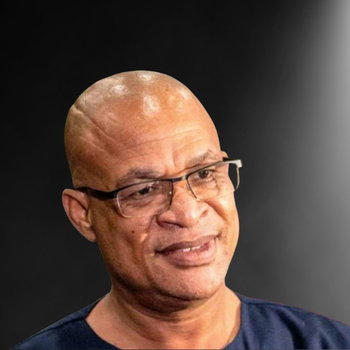

Small and medium business are in a particular squeeze right now as the quantitative easing measures from Government are not filtering down to them fast enough. In the United Kingdom, it is estimated that the economic impact of the coronavirus could lead to one in five SMEs running out of cash. In South Africa, Brendan Mullen from Secha Capital, whose biggest business is Stoffelberg Biltong, is an investment professional who has experienced the fall-out from the credit crunch in 2009. He says this time round the “war” as he calls it is not a Top Down one in the previous crisis; it is a Bottom Up War as the real victims are the SMEs. He told Alec Hogg that there should be a public-private partnership where credit lines can be extended quicker to keep the economy moving. The large supermarkets, he said should be more lenient with the smaller suppliers on payment terms. – Linda van Tilburg Learn more about your ad choices. Visit megaphone.fm/adchoices